ANNEX

PREVIOUS CHAPTER PREVIOUS CHAPTER |

BACK TO CONTENT .png) |

ANNEX

.png) Methodology

Methodology

.png) Emerging spots in mobile and mobile service industry Europe

Emerging spots in mobile and mobile service industry Europe

.png) References

References

METHODOLOGY

In order to foster mobile and mobile service industries in Europe a methodology to evaluate emerging european spots has been developed. A massive convergence is underway today: social media, mobile & internet communication, clouds and large scale information databases (such as information from Copernicus and signals from Galileo) are transforming and building upon new user experiences and engagement while creating new business opportunities at the same time.

Although these forces are disruptive by themselves, taken together at a systems level they are reshaping the whole of society and the business world; shaking up old business models and creating exciting opportunities for new leaders. As such, the convergence of these forces is creating the basis of the technology platforms for the future. In this convergence of forces, information is the context for delivering enhanced mobile services like new location based services (LBS) around the concept of “Place” and new mobile experiences on a larger scale.

Understanding how to capture the power of the ubiquity of information and focus on the smaller subset that is applicable to a specific company, product, service and/or client at a specific point in time, are critical factors driving new opportunities. Developing a discipline of innovation through information will enable organisations to adapt to client, employee, product or environ-mental changes. It will enable companies to move ahead of their competition. Ventures must take into account and respond to trends such as social media, mobile & internet communication, clouds and large scale information databases. In a world where everything is connected, every company has now become a technology company.

Mobilise Europe is an initiative that has been set up with the aim of under-standing the drivers and barriers that enable the development of a strong Mobile and Mobile service Industry across Europe thereby creating more jobs and economic activity. The European Mobile & Mobility Industry Alliance (EMMIA) which is responsible for the mobilise Europe campaign has been created with the support of the European Commission. The EMMIA Policy Learning Platform (PLP) was set-up right at the beginning of the initiative.

It drafted an EMMIA Terms of Reference and Roadmap (D2.1.1) in order to better assist and address the challenges ahead. The EMMIA PLP has set up a number of eco-system support working groups (WGs) to prepare individual implementation roadmaps for validation through consultation with external stakeholders. Three working groups have been set up in the areas of better business support (BBS), access to finance (A2F), and Large Scale Demonstrators & Interoperability (LSDI). The three WGs have gathered experts who have deep knowledge and experience in the related fields at regional level.

.jpg)

The EMMIA methodology was presented in December 2012 and validated by the European Commission. This methodology consists of the following five steps:

Step 1: To gather statistics on emerging spots for mobile and mobile service industries and their related policies, without excluding professional "feelings" based on a proven know how ("gut feeling");

Step 2: To generate a long list of (20+) of these European emerging spots (with and without rankings);

Step 3: To study the "real cases" mainly in a Face to Face manner with a unified and consistent methodology (how to do it) and to come up with a list of five emerging spots selected as "best to learn from" cases. To define robust indicators (10 indicators were defined) on policies implemented for comparisons defined by spider diagrams (mapping) or indexes;

Step 4: To validate the first set of results/outputs and outcomes for recommendations for future policies (EC DGs, regions and cities);

Step 5: To disseminate the information with clear, visible and understandable results.

ENCADRE-EMMIA-Methodology

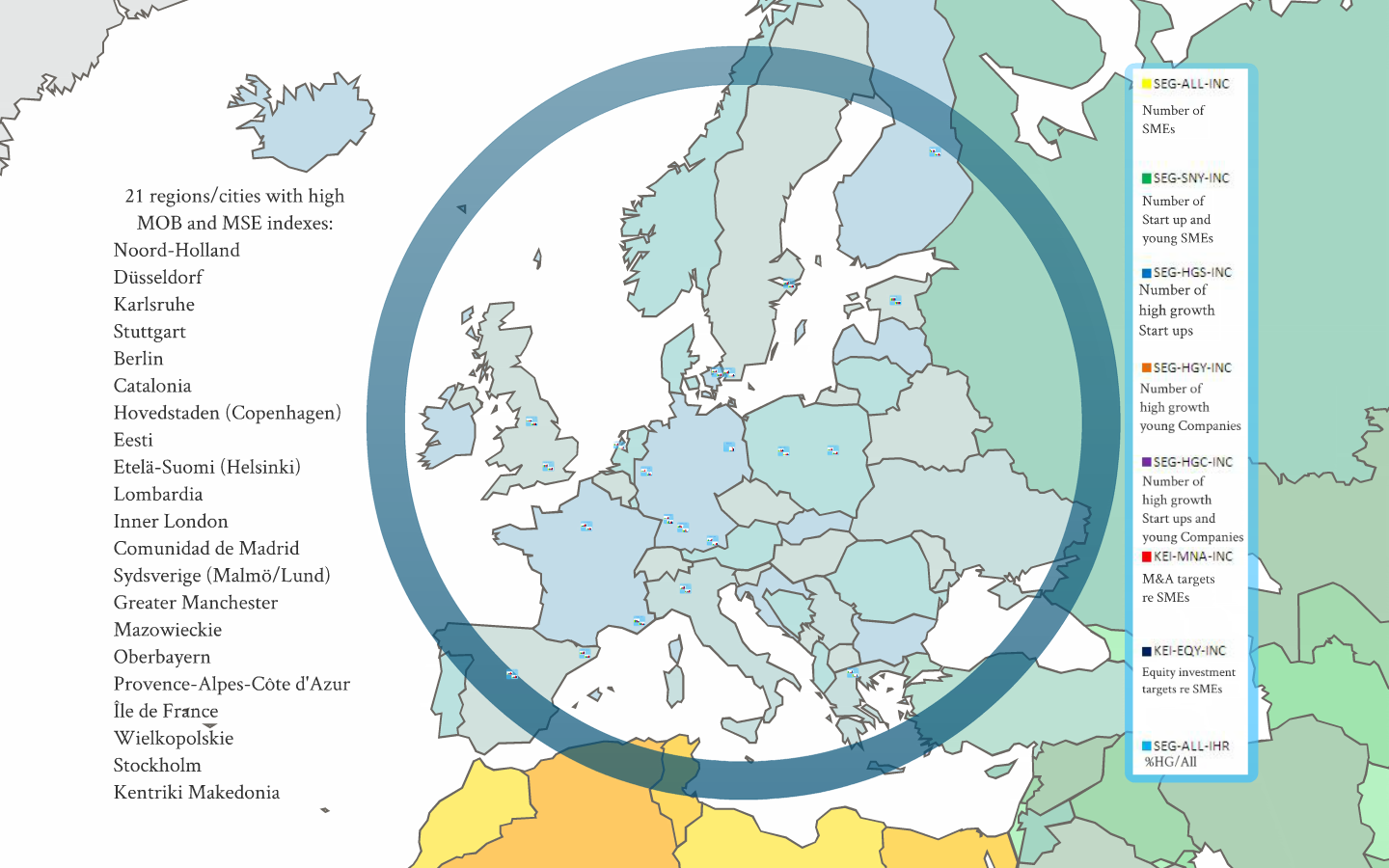

Based on a study of the European Cluster Observatory (ECO) and the methodology developed by the consulting firm PricewaterhouseCoopers, 21 NUTS regions were identified that were all being affected both with a mobility index (MOB index) and a mobile service index (MSE index), constituted by eight uncorrelated indicators of concentration.

In parallel, an important gathering of data (quantitative and qualitative) took place between January and April 2013, enriched by inputs from ECIAP (European Creative Industry Alliance Platform), Mobicap partners (EMMIA Access to Finance - concrete action), PLP experts (including ENCADRE President -Cluster 55 Manager).

Identification of 20+ Emerging spots

|

|

|

Map 1:

|

Map 2:

|

In step 3, the main objective was to select the best 5 cases "to learn the most" from the above list of the 20+ selected regions and then to determine robust indicators for index analysis and mapping (spider diagrams). For that, a series of interviews (series A) was held directly on site before the PLP3 experts' meeting. The PWC questionnaire was used as a basis for this, aiming particularly at better understanding the regional business environment i.e. the framework conditions (FC) by assessing key factors such as Financial supports, Industry presence, Market conditions, Knowledge excellence, Regu-latory and Policy environment, Support measures and Cultural development. The PLP interviewers also evaluated the Firms Strengths (FS) present in the selected regions by using indicators such as Access to Funding, National and International contracts, Internationalisation, Human Capital, Entrepre-neurship, Market Knowledge and Innovation Capacity. Finally, the PLP inter-viewers assessed the provided business regional supports (BS) at clusters' level evaluating at the same time the availability and effectiveness of the provided services. This PWC questionnaire (FC, FS and BS) is the tool to pro-duce the indexes used in the PWC Emerging Industries scoreboard.

The PLP3 meeting (step 4) was then an ideal place for validating the first obtained "real results". At that occasion, the PWC questionnaire (which is a general tool for Emerging Industries) was refined during the different vertical WGs sessions.

With the outputs gathered, a new series of interviews (series B) was comple-ted with key stakeholders groups such as firms, investors, business accele-rators, policy makers, regional authorities, cluster organisations, research departments and technology transfer organisations in London, Berlin, Barcelona, Estonia and Malmo/Lund.

10 indicators (ranging from 1 to 10) were used for assessment and compari-sons (they are depicted in details in the annex).

The 10 indicators are:

- General impression

- Start Ups

- Clusters

- Informal structures

- Formal support

- Events

- Industrial history and synergies

- Financial tools and support

- Market

- Knowledge

To capture the essence of the ongoing changes were not so difficult when fully understanding that the web is the most powerful driving force behind all these new emerging mobile and mobile service industries. “The web will be everything and it will be nothing. It will be like electricity“, explained Eric Schmidt, Google, during a recent keynote. But when it comes to predict exactly which technologies will enable a new service to access the market and to be developed on a larger scale or where this will take place, the task becomes really hard.

In this very fast changing environment and more especially in this field where mobile and mobile service industries are both the driving forces for the creation of Emerging Industries and the receptacle of these changes, drafting policy recommendations is not so an easy task. And this was the case for drafting the methodology as well.

.png) Methodology

Methodology

.png) Emerging spots in mobile and mobile service industry across Europe

Emerging spots in mobile and mobile service industry across Europe

.png) References

References

PREVIOUS CHAPTER PREVIOUS CHAPTER |

BACK TO CONTENT .png) |